After a period of abnormal calm in the markets over the last 18 months, the increase in the stock market’s volatility has resulted in renewed anxiety for many investors.

Unfortunately, this anxiety is greatly amplified by the constant barrage of headlines such as “1,000-point drop is the largest decline ever”. These headlines are eye-catching and good for

ratings. While the numbers may be technically accurate, they are framed to frighten rather than enlighten investors. Remember black Monday in 1987 was a 508-point drop or a 22% decline.

The largest daily decline during the recent volatility was a 1,175-point drop which was a 4.6% decline, hardly the decline seen in 1987.

Much of the current volatility is attributed to rising yields and inflation expectations. Typically, as the Fed raises rates, financial conditions tighten, and thus bank borrowing and economic activity

slows, leading to a potential downturn in the economy. But the economy is very healthy with no sign of an impending recession. Economic momentum has been gaining in the US and globally,

and corporate earnings have been strong and exceeding expectations.

One thing to remember is that corrections can occur, even when all the economic and financial indicators seem positive. And every correction gives flashbacks to the last significant decline such

as seen in 2007.

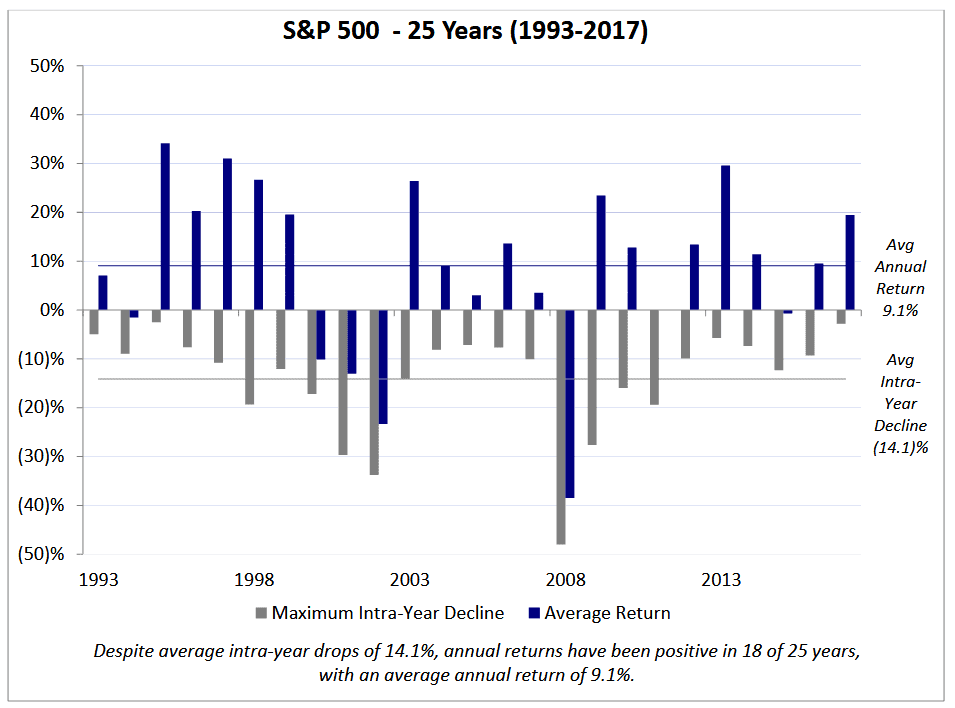

While it may be difficult to remain calm, it is important to remember that volatility is a normal part of investing and that market corrections aren’t rare events. The chart below shows the calendar year returns for the S&P 500 over the last 25 years (1993 – 2017), as well as the largest intra-year declines that occurred during a given year. Keep in mind, this analysis ignores the

impact of dividends by only looking at the price appreciation of the index.

During this period, the average intra-year decline was 14.1%. One year in six experienced an intra-year decline of greater than 20%. Despite substantial intra-year drops, calendar year returns were positive in 18 years out of the 25 examined. This goes to show just how common market declines are and how difficult it is to say whether a large intra-year decline will result in negative returns over the entire year.

The biggest thing to remember is that market corrections are a part of investing and that no one has a clue what’s going to happen next. Short-term market moves are controlled by human

emotions, which are impossible to predict.

So, unless your personal goals have changed, remain steadfast and committed to your personal plan. If, however, you believe your tolerance for risk has changed, please reach out to us and we’ll work together to get you into a plan that allows you to sleep well at night.

As always, we appreciate your continued trust in Optima.